Key Takeaways

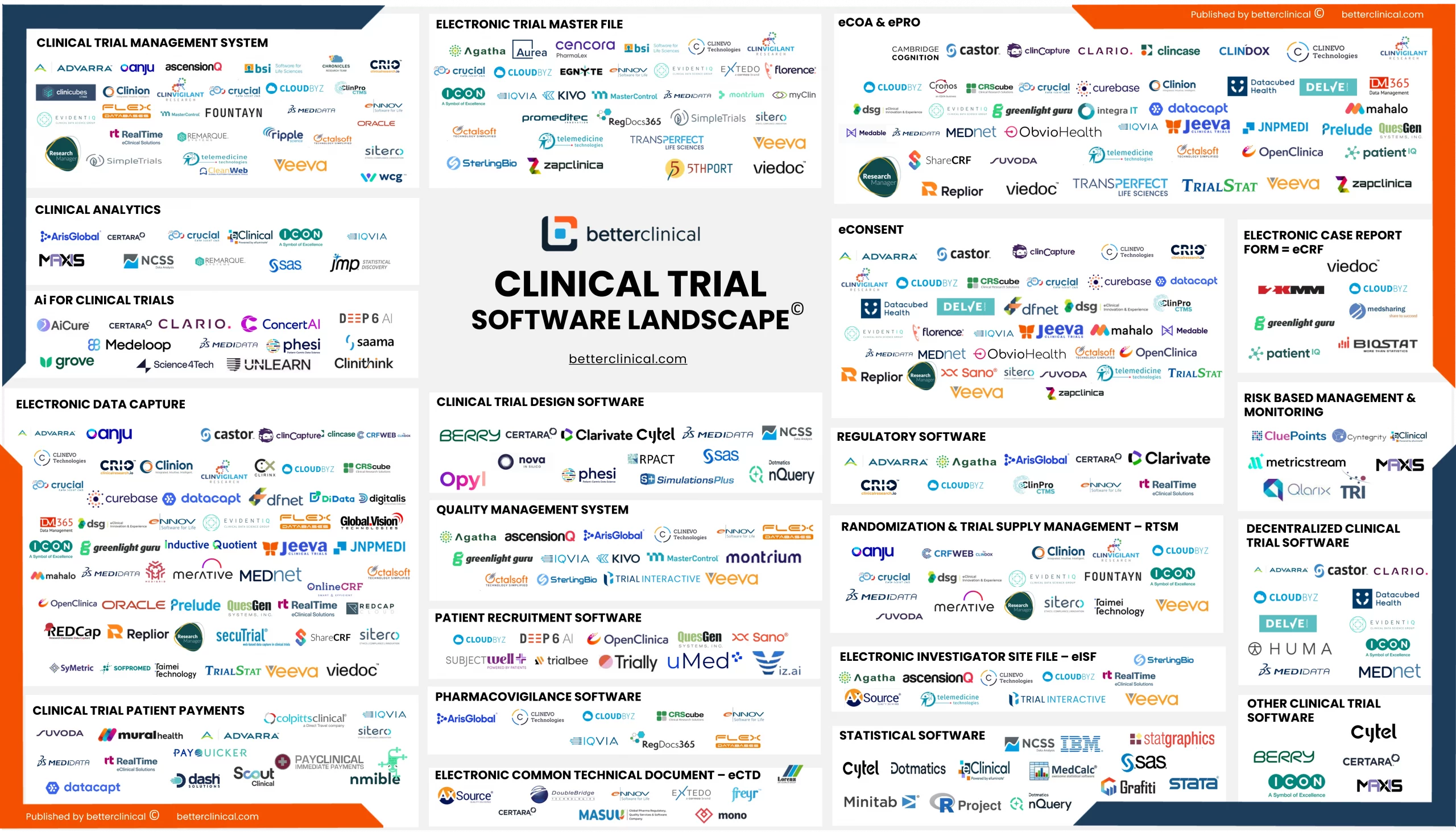

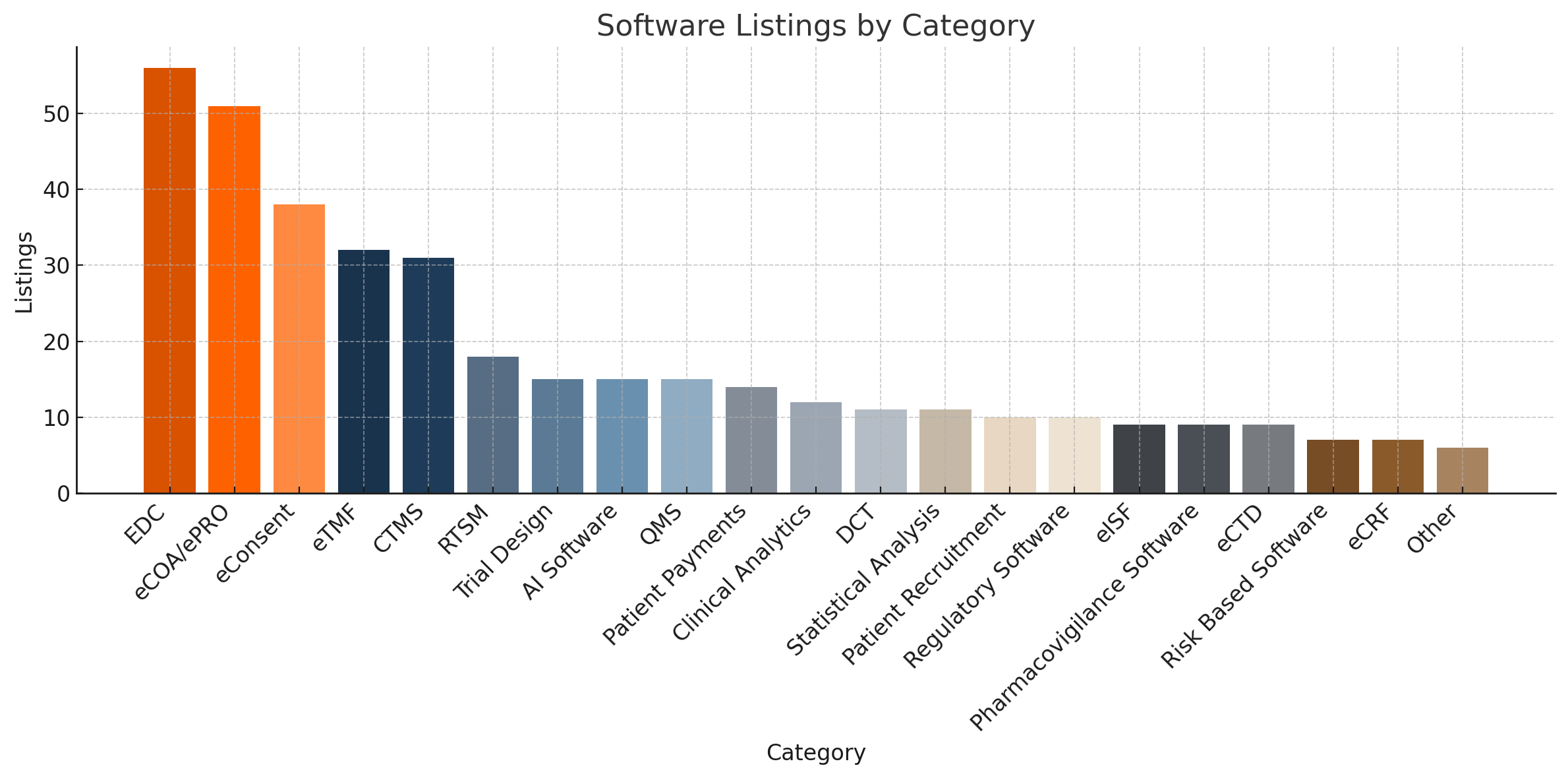

The clinical trial software market is bigger and more specialized than most buyers realize. No longer should clinical trial software only be associated with CTMS (operations), EDC (data capture), and eTMF (documents). Today’s trials run on a much wider software stack. However, the market is crowded and fragmented. Tools blend into one another, suites overlap with point solutions, and the same vendor often appears in multiple software buckets.

The Clinical Trial Software Landscape was put together to try and put hundreds of software solutions in one place and organize them into 20 practical categories. (21 actually).

As far as we know, it is the most complete collection of Clinical Trial Software in one visual illustration.

Table of Contents

Highlights

There are more software solutions launching every month and we are certain we missed a few. Nevertheless, it’s a start that we hope will be useful for sponsors, CROs, sites, and investors to help see the whole field at a glance.

Use it as a reference when auditing your stack, shortlisting vendors, investing or other research objectives.

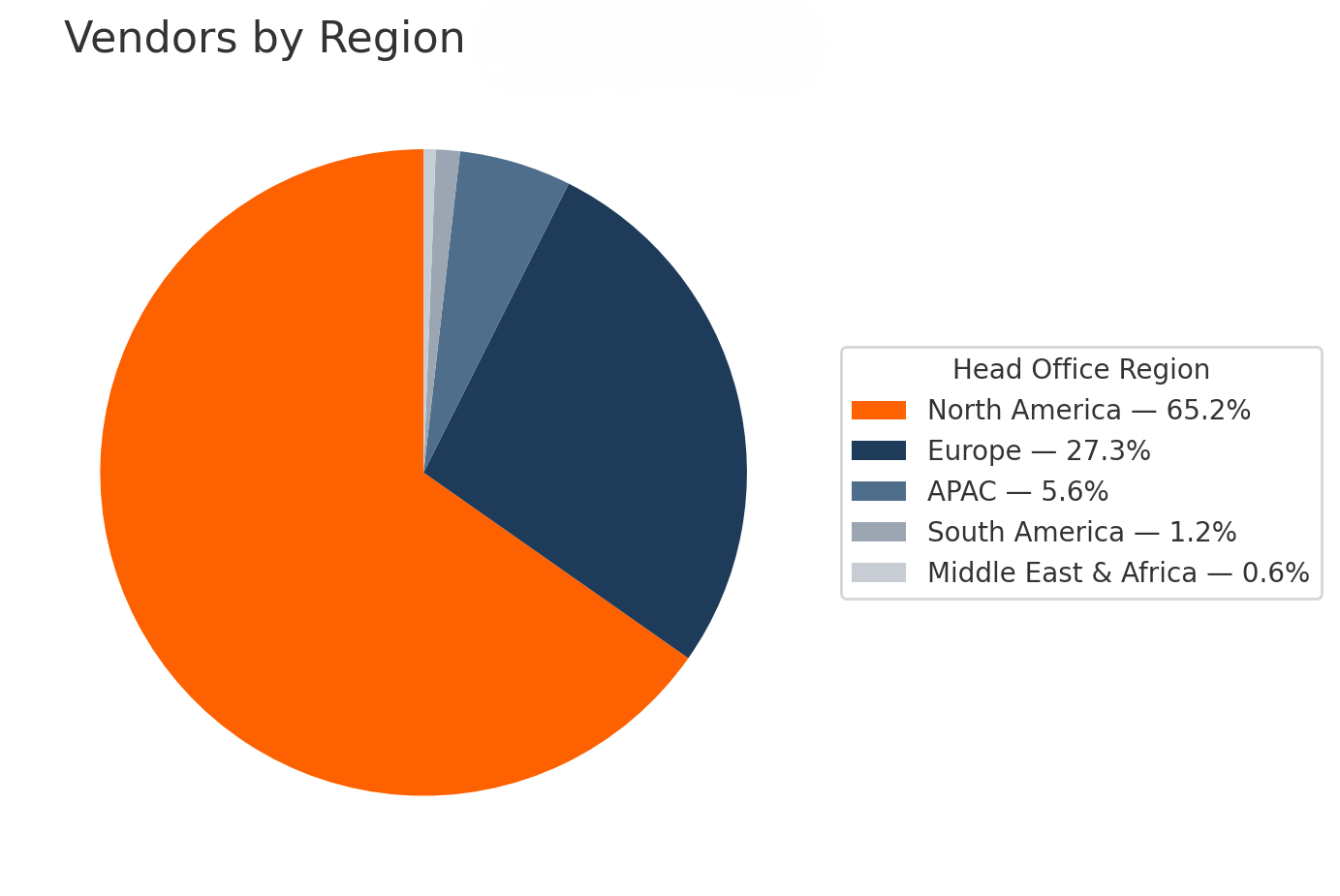

Geography

You’ll find the deepest choice set in North America and Europe. Over 92% of all vendors come from these 2 areas. However, there is meaningful (and growing) representation in APAC.

# of Software Solutions

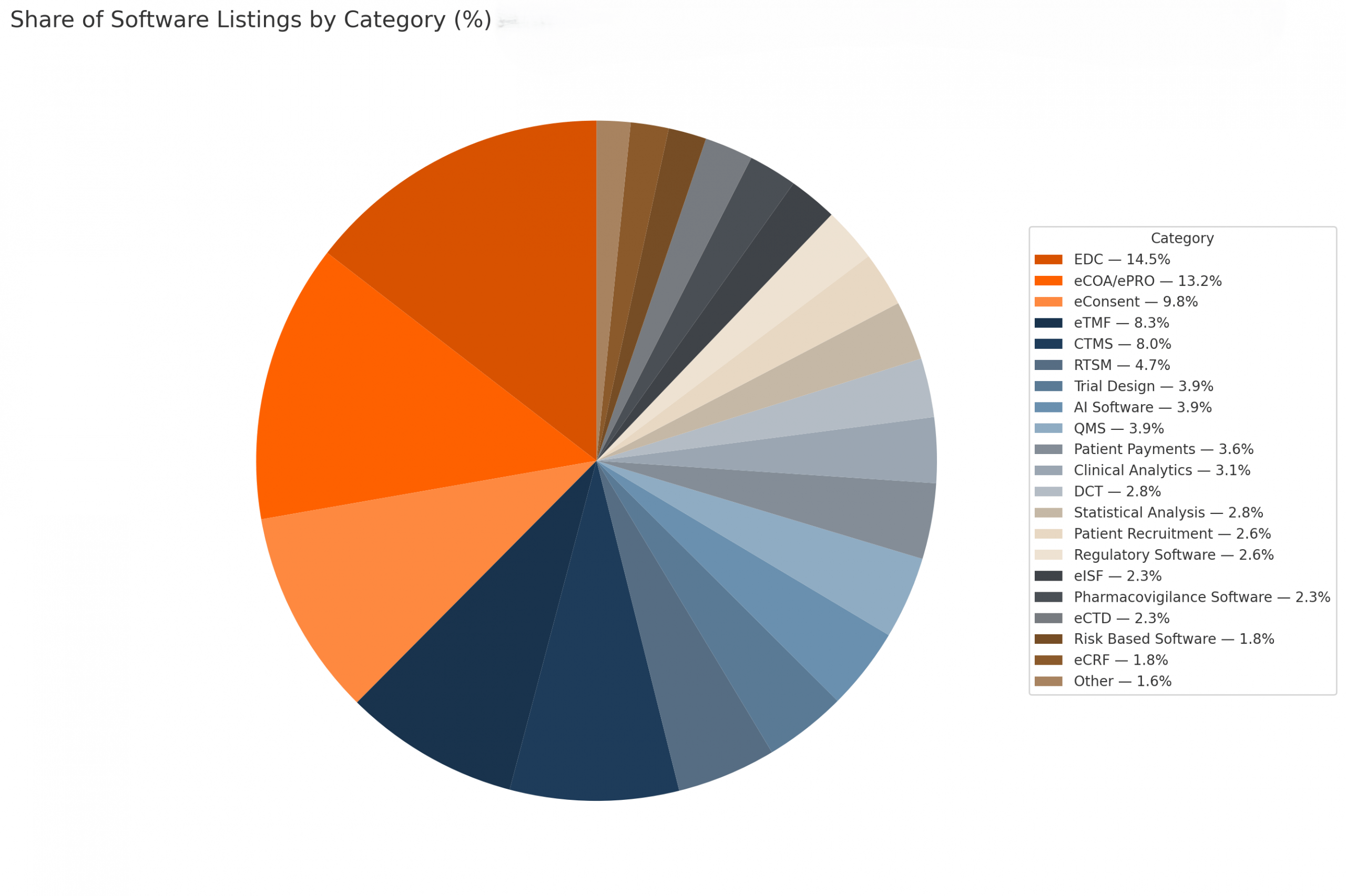

There are about 400 software solutions showcased in the landscape, represented in 20 specific categories plus an "other" category. Close to 38% of all listings focus on Data Capture from EDC, eCOA/ePRO and eConsent.

Category Concentration

The top five categories of EDC, eCOA/ePRO, eConsent, eTMF, CTMS account for ~54% of all listings. That concentration shows where software vendors have placed their focus; on optimizing data capture, patient input, and trial operations. The long tail (RBQM, eCTD, analytics, payments, etc.) is smaller in count but strategically critical.

The Clinical Trials Software Landscape

Category Definitions

Clinical Trial Management System (CTMS)

Coordinates operational workflows across study, country, and site levels with governed tasking, budgets, and monitoring. The benefit is a single operational system of record that enforces SOPs and inspection-readiness.

Electronic Data Capture (EDC)

Structures patient-level clinical data in eCRFs with validations, queries, and audit trails. The benefit is reliable, analysis-ready data with reduced rework before lock.

Electronic Trial Master File (eTMF)

Controls essential documents with versioning, access controls, and completeness checks. The benefit is continuous inspection-readiness and traceable document lifecycles.

AI Software for Clinical Trials

Applies machine learning to anomaly detection, protocol deviation flagging, feasibility, and recruitment targeting. The benefit is faster, more precise decisions from large supplies of data .

Regulatory Software

Manages submission planning, publishing, lifecycle tracking, and correspondence. The benefit is predictable, compliant submissions with clear traceability across sequences and variations.

Randomization & Trial Supply Management (RTSM/IRT)

Executes allocation, blinding, and supply logistics with real-time inventory controls. The benefit is error-resistant randomization and on-time drug availability without compromising blinding.

eConsent

Delivers consent content digitally with version control, comprehension checks, and attestations. The benefit is cleaner consent records and fewer protocol deviations tied to consent errors.

eCOA & ePRO

Captures clinician and patient-reported outcomes via validated instruments on compliant devices. The benefit is higher-fidelity endpoint data with time-stamped, source-verifiable entries.

Clinical Analytics

Aggregates signals from relevant trial sources into standardized metrics and dashboards. The benefit is earlier detection of risk and tighter control of trial performance.

Decentralized Clinical Trial (DCT) Platforms

Enable hybrid/remote workflows televisits, eSource capture, device/wearable ingestion, and home health coordination. The benefit is participant-centric operations with fewer site burdens and more continuous data.

Patient Recruitment Software

Orchestrates feasibility, cohorting, referral channels, and screening workflows with compliance safeguards. The benefit is faster enrollment with better match quality and reduced screen failure rates.

Quality Management System (QMS)

Harmonizes CAPA, deviations, change control, training, and controlled documents across GxP processes. The benefit is auditable, consistent quality operations aligned to regulated expectations.

Pharmacovigilance (PV) Software

Supports case intake, coding, signal detection, and safety reporting. The benefit is compliant, timely safety surveillance with defensible signal workflows.

Electronic Investigator Site File (eISF)

Provides sites with a controlled repository for essential documents, logs, and communications. The benefit is synchronized sponsor–site documentation and reduced reconciliation effort.

Clinical Trial Design Software

Assists protocol and statistical design, arms, endpoints, power, simulations and downstream feasibility checks. The benefit is better designed studies with fewer mid study amendments.

Electronic Case Report Form (eCRF) Builders

Define form libraries, edit checks, derivations, and visit schedules used by EDC. The benefit is consistent, reusable data models that accelerate study startup and minimize data cleaning.

Risk-Based Management & Monitoring (RBM/RBQM)

Scores risks, targets monitoring, and tracks mitigation effectiveness across data and processes. The benefit is proportionate oversight that cuts noise and concentrates on what matters.

Electronic Common Technical Document (eCTD) Tools

Package, validate, and publish submissions in CTD structure with lifecycle management. The benefit is standards compliant publishing with fewer technical validation findings.

Statistical Analysis Software

Implements data transformation, modeling, and TLF generation under controlled programming practices. The benefit is reproducible analyses and submission grade outputs with full traceability.

Clinical Trial Patient Payments

Automates participant stipends, travel reimbursement, and tax/compliance records. The benefit is faster, transparent payments that improve participant experience and retention.

Bottom line

The clinical trial software sector is bigger than people think and more specialized than budgets assume. The bulk of about 400 solutions cluster around data capture and operations (EDC, ePRO/eCOA, eConsent, CTMS, eTMF)

Cloud solutions are rising yet on-premise solutions remain important for data-sensitive operations, while North America and Europe continue to dominate.

It will be interested to see what the next year brings given the technology trends shaping the future of clinical trials. AI-driven patient recruitment, risk-based monitoring, eConsent, and eCOA platforms are increasingly mainstream and Ai solutions are expected to grow further.

We are also seeing a trend in the industry emphasizing all-in-one integrated systems.

Review all software listings & vendors in our comprehensive directory.

Reach out

If you are a vendor and don’t see your solution included in certain categories, contact us to make sure you are included in the next update. If you feel the Landscape can be improved, please reach out so we can update accordingly.